What will the impact of inflation be in the coming years? The answer is it varies according to your age and spending patterns. As you know, inflation is a sustained increase in prices for general goods and services in the economy and is typically measured annually. Theoretically speaking, as inflation rises, every dollar you own buys a smaller amount of a good or service.

What will the impact of inflation be in the coming years? The answer is it varies according to your age and spending patterns. As you know, inflation is a sustained increase in prices for general goods and services in the economy and is typically measured annually. Theoretically speaking, as inflation rises, every dollar you own buys a smaller amount of a good or service.

While the reported inflation rate (typically reported as the CPI or Consumer Price Index) is important for Social Security income calculations, which rise with the index, it may not accurately reflect your individual inflation rate.

The Spring of 2022 & Inflation

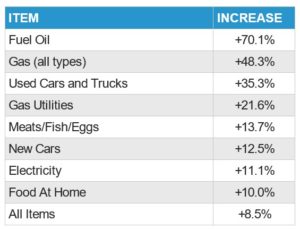

Unless you’ve been living under a rock, you already know that inflation – as measured by the Consumer Price Index for All Urban Consumers – jumped again last month (and the month before and the month before…) and now stands at a whopping 8.5% on a yearly basis.

For perspective, the annual inflation number was 2.6% in March of 2021 and a paltry 1.7% the month before. We are now witnessing the highest annual inflation in over 40 years.

Here are a few of the specific price increases we’ve felt over the last year:

Inflation is Personal

While inflation impacts all of us, it also impacts all of us differently. Why? Well, because we get to choose some financial expenses and lifestyle choices, whereas others we must just accept.

People planning to retire commonly ask how to calculate the future rate of inflation because projecting what price increases lie ahead is central to anticipating annual income needs.

Sadly, there is no magic number. And often times the assumed number can be flawed and can vary significantly from one family to the next.

For example, if you enjoy travelling, you will likely incur many service expenses including hotels, dining, and transportation, thus you should expect travel inflation will be higher than the reported CPI. Travel expenses tend to increase in the early years of retirement and slow later on as people take fewer trips.

On the other hand, if you are a homebody who does your own yardwork and property improvements, then you will likely encounter lower inflation levels relative to your traveling friends (although lumber prices have skyrocketed).

What is Your Personal Inflation Rate?

The key point is that your personal inflation rate is unique based on your age and your lifestyle. The headline CPI number is important only as a general gauge.

The more we consider prices as they relate to goods of the economy – and the lifestyle of the investor – the more accurate we can be in estimating an inflation number. For now, car dealerships are loving the higher prices for used cars and trucks. And medical services providers are jealous.

Our Custom Retirement Paycheck Plan shows how to protect your retirement from the risks of unexpected market swings, tax changes, AND inflation using a mathematically tested strategy to create lifetime income allowing you to stop worrying about outliving your money and get on with enjoying the rest of your life.

Let us show you in black and white a custom retirement income plan that is comprehensive, individualized and based on strategies that balance growth with downside protection. Get your Custom Retirement Paycheck Plan now!

Give us a call at our Charlotte office at (704) 248-8549, or our Clemmons office at (336) 391-3409. Or, click here to request a no-cost, no-obligation meeting.

[SOURCES & ADDITIONAL DISCLOSURES]

Copyright © 2022 FMeX. All rights reserved. Distributed by Financial Media Exchange.