Whole life insurance is designed to remain in force for your whole life, as long as you remain current with your premiums.

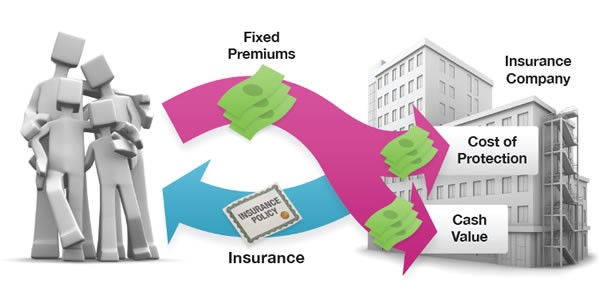

In exchange for fixed premiums, the insurance company promises to pay a set benefit when the policyholder dies. Whole life insurance policies can build up cash value — effectively a cash reserve that pays a modest rate of return. This growth is tax deferred. Guarantees are based on the claims-paying ability of the issuing company.

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

Whether whole life insurance is the best choice for you may depend on a variety of factors, including your goals, needs, and circumstances.

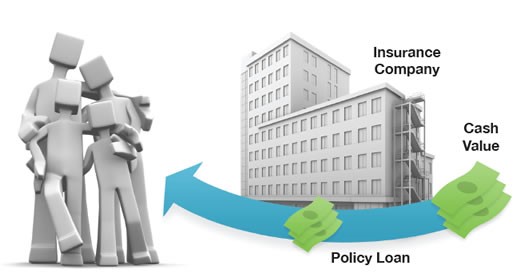

Accessing the cash value of the insurance policy through borrowing — or partial surrenders — has the potential to reduce the policy’s cash value and benefit. Accessing the cash value may also increase the chance that the policy will lapse and may result in a tax liability if the policy terminates before your death.

Keep in mind that several factors will affect the cost and availability of life insurance, including age, health and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policy holder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Life insurance is not insured by the FDIC (Federal Deposit Insurance Corporation). It is not insured by any federal government agency or bank or savings association.

Generally, loans taken from a policy will be free of current income taxes, provided certain conditions are met, such as the policy does not lapse or mature. Loans and withdrawals reduce the policy’s cash value and death benefit. Loans also increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance will be considered a distribution and will be taxable.

The Wealth Guardians are here to collaboratively help you determine if whole life insurance is the best coverage for you. Click here to schedule a no-cost, no-obligation second opinion of your current plan. Or, give us a call at our Charlotte office at (704) 248-8549, or our Clemmons office at (336) 391-3409.

SOURCES:

- Original article by FMG Suite, 2020