We’re a full-service wealth management firm focused on retirement income and believe our relationships begin with a foundation of truth and honesty. We’re interested in building long-term relationships, not brokering transactions. Our clients are like family and not everyone who completes our process will be a fit for our practice.

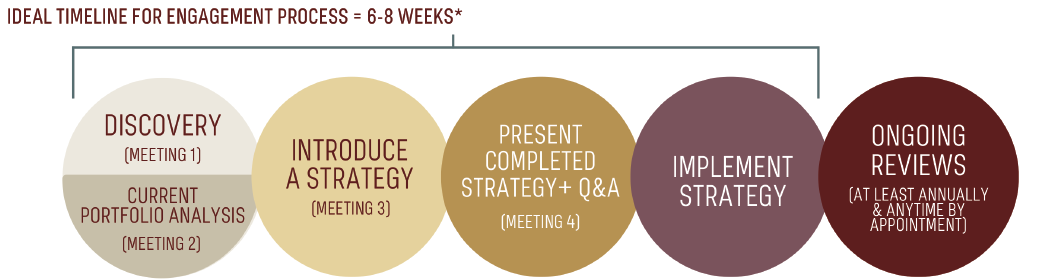

Having additional certification as Retirement Income Certified Professionals® uniquely positions our advisors to meet the needs of guiding our clients through the transition of asset accumulation to asset distribution, creating a predictable income stream throughout retirement. The process of crafting your Custom Retirement Paycheck Plan generally involves these steps towards the goal to Retire the Job and KEEP the PaycheckTM.

DISCOVERY (Meetings 1 & 2)

- Get to know one another including how we get paid.

- Discuss current plan & goals.

- Identify risk tolerance.

- Analyze risk, fees & tax inefficiencies of current portfolio.

- Show Social Security Optimization strategy.

INTRODUCE A STRATEGY (Meeting 3)

- Craft a custom plan to protect desired lifestyle.

- Provide recommendations to contain losses, cut fees & risks, improve tax efficiencies.

- Side-by-side comparison of current plan vs. recommendations.

- Live, on-screen “what if” scenarios.

- Adjust plan with desired changes.

FINALIZE STRATEGY (Meeting 4)

- Review final plan & address questions.

- Decide if a fit exists to move forward.

- Plan initiated with signatures.

- Presentation of bound plan with decision to become a client.

IMPLEMENT STRATEGY

- Deliver leather portfolio with hard documents.

- Review log-in information, office contacts, and communication policies.

- Establish trusted contact.

ONGOING REVIEWS (At Least Annually & Anytime by Appointment)

- Review & adjust plan based on life changes & plan performance.

- Address ongoing strategies for tax efficiency based on current opportunities.

- Address Long-Term care needs & coverage.

- Address Legacy goals.

KEY RELATIONSHIPS

The Wealth Guardians is a fiduciary, and because we are an independent wealth management firm, we protect our clients’ best interest by separating custodian, advising and oversight duties. The entities below are the primary sources responsible for fulfilling different obligations to our clients, though needs occasionally require additional options.