Advice from the Social Security Administration can guide your decision.

Advice from the Social Security Administration can guide your decision.

One of the most vexing questions when planning for retirement is: “What’s the best age to start receiving Social Security benefits?” There are are hundreds of filing strategies and finding the one the maximizes your lifetime income vs. simply filing at a specific age can mean the difference of hundreds of thousands of dollars over your lifetime.

When to start receiving retirement benefits.

“At Social Security, we’re often asked, “What’s the best age to start receiving retirement benefits?” The answer is that there’s not a single “best age” for everyone and, ultimately, it’s your choice. The most important thing is to make an informed decision. Base your decision about when to apply for benefits on your individual and family circumstances.

Your decision is a personal one.

Would it be better for you to start getting benefits early with a smaller monthly amount for more years or wait for a larger monthly payment in a shorter timeframe? The answer is personal and depends on several factors, such as your current cash needs, your current health, and family longevity. Also, consider if you plan to work in retirement and if you have other sources of retirement income.

You must also study your future financial needs and obligations and calculate your future Social Security benefit. It’s critical to weigh all the facts carefully before making the crucial decision about when to begin receiving Social Security benefits since it affects the monthly benefit you will receive for the rest of your life and may affect benefit protection for your survivors.

Your monthly retirement benefit will be higher if you delay starting it.

Your full retirement age varies based on the year you were born. You can visit www.ssa.gov/benefits/retirement/planner/ageincrease.html to find your full retirement age. We calculate your basic Social Security benefit — the amount you would receive at your full retirement age — based on your lifetime earnings. However, the actual amount you receive each month depends on when you start receiving benefits. You can start your retirement benefit at any point from age 62 up until age 70. Your benefit will be higher the longer you delay starting it. This adjustment is usually permanent: it sets the base for the benefits you’ll get for the rest of your life. You’ll get annual cost-of-living adjustments and, depending on your work history, may receive higher benefits if you continue to work.

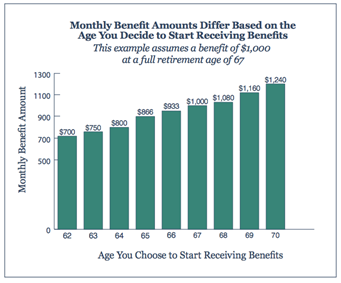

The following chart shows an example of how your monthly benefit increases if you delay when you start receiving benefits.

Let’s say you turn 62 in 2022, your full retirement age is 67, and your monthly benefit starting at full retirement age is $1,000. If you start getting benefits at age 62, we’ll reduce your monthly benefit 30% to $700 to account for the longer time you receive benefits. This decrease is usually permanent.

If you choose to delay getting benefits until age 70, you will increase your monthly benefit to $1,240. This increase is the result of delayed retirement credits you earn for your decision to postpone receiving benefits past your full retirement age. The benefit at age 70 in this example is about 77% more than the benefit you will receive each month if you start getting benefits at age 62 — a difference of $540 each month.

Retirement may be longer than you think.

When thinking about retirement, be sure to plan for the long term. Many of us will live much longer than the “average” retiree, and most women live longer than men. About 1 out of every 3 65-year-olds today will live until at least age 90, and 1 out of 7 will live until at least age 95. Social Security benefits, which last as long as you live, provide valuable protection against outliving savings and other sources of retirement income.

Married couples have two lives to plan for.

Your spouse may be eligible for a benefit based on your work record, and it’s important to consider Social Security protection for widowed spouses. After all, married couples at age 65 today would typically have at least a 50-50 chance that one member of the couple will live beyond age 90. If you are the higher earner, and you delay starting your retirement benefit, it will result in higher monthly benefits for the rest of your life. If you die first, it will result in higher survivor protection for your spouse.

When you are receiving retirement benefits, your children may also be eligible for a benefit on your work record if they’re under age 18 or if they have a disability that began before age 22.

You can keep working.

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment but there could be tax ramifications so it’s important to look at the whole picture. If you’re younger than full retirement age and if your earnings exceed certain dollar amounts, some of your benefit payments during the year will be withheld.

You can find more information about working after retirement at www.ssa.gov/benefits/retirement/planner/whileworking.html.

Don’t forget Medicare.

If you plan to delay receiving benefits because you’re working, you’ll still need to sign up for Medicare 3 months before reaching age 65. If you don’t enroll in Medicare medical insurance or prescription drug coverage when you’re first eligible, you can sign up later. However, you may have to pay a late enrollment penalty for as long as you have coverage. You can find more detailed information about Medicare at www.ssa.gov/benefits/medicare.

More resources.

You can find more information to help you decide when to start receiving retirement benefits at www.ssa.gov/benefits/retirement. If you have a personal my Social Security account, you can get your Social Security Statement, verify your earnings, and get personalized benefit estimates at www.ssa.gov/myaccount.”

The Wealth Guardians are here to help guide you through the complex questions and discover how Social Security can be an important piece of your overall retirement plan. Our sophisticated Social Security filing software can pinpoint the best strategy for you to pocket the most money over your lifetime based on your individual circumstances. Our Custom Retirement Paycheck Plan shows how to protect your retirement from the risks of unexpected market swings, tax changes, and health care expenses using a mathematically tested strategy to create lifetime income allowing you to stop worrying about outliving your money and get on with enjoying the rest of your life.

Let us show you in black and white a custom retirement income plan that is comprehensive, individualized and based on strategies that balance growth with downside protection. Get your Custom Retirement Paycheck Plan now!

Give us a call at our Charlotte office at (704) 248-8549, or our Clemmons office at (336) 391-3409. Or, click here to request a no-cost, no-obligation meeting.

[SOURCE]

- SSA.gov

- Copyright © 2022 FMeX. All rights reserved. Distributed by Financial Media Exchange.